You’re probably leaving six figures on the table every year. Not because you’re bad at business. Not because you don’t work hard enough. But because of something you can’t see clearly: the psychology that keeps you charging less than you’re worth.

The Silent Profit Killer

You know that knot in your stomach when a prospect asks “what do you charge?” The slight hesitation before you say the number. The way you rush through the price like you’re apologizing for it. You watch competitors with half your skill charge twice your rate and win the same clients. You tell yourself you’ll raise prices “next quarter” but next quarter never comes. Meanwhile, you’re working more hours than ever, your margins are getting squeezed, and you can’t figure out why the business that was supposed to give you freedom feels more like a trap every year.

Now imagine the opposite. Quoting your price without flinching. Clients saying yes without haggling. Fewer clients but more profit, better projects, and actual breathing room in your calendar. That’s not a fantasy. That’s what happens when you fix the pricing psychology first.

There’s a pattern across service businesses that repeats itself constantly. Owners set prices five years ago based on what they thought the market would bear. Costs have increased 30% since then. Prices haven’t moved. The math doesn’t lie, but the fear of changing it does.

This isn’t just about making less money per job. Underpricing creates a cascade of problems that touch every part of the business. It attracts the wrong clients. It prevents hiring good people. It traps owners in survival mode when they should be in growth mode. The damage compounds silently, month after month.

Most pricing conversations focus on tactics. How to set prices. What to charge. Tiered structures. But tactics don’t matter if the psychology is broken. Before you can fix your pricing, you have to understand why smart, capable business owners consistently undervalue themselves. The problem isn’t math. The problem is what you believe about yourself and your worth.

The Other Side of Pricing Psychology

When most people think about pricing psychology, they think about consumer tactics. Charm pricing. Anchor pricing. The tricks that make $9.99 feel cheaper than $10. There are entire frameworks dedicated to this. But there’s a different kind of pricing psychology that nobody talks about: the psychology that keeps business owners from charging what they’re worth in the first place.

As a Certified Profit Advisor and author of “Profit Foundation,” I’ve conducted hundreds of conversations with service business owners about their pricing. I’m not a pricing consultant who works with Fortune 500 companies. I work with owner-operated businesses between $250K and $5M in revenue, the businesses where pricing decisions happen at the kitchen table, not in a boardroom.

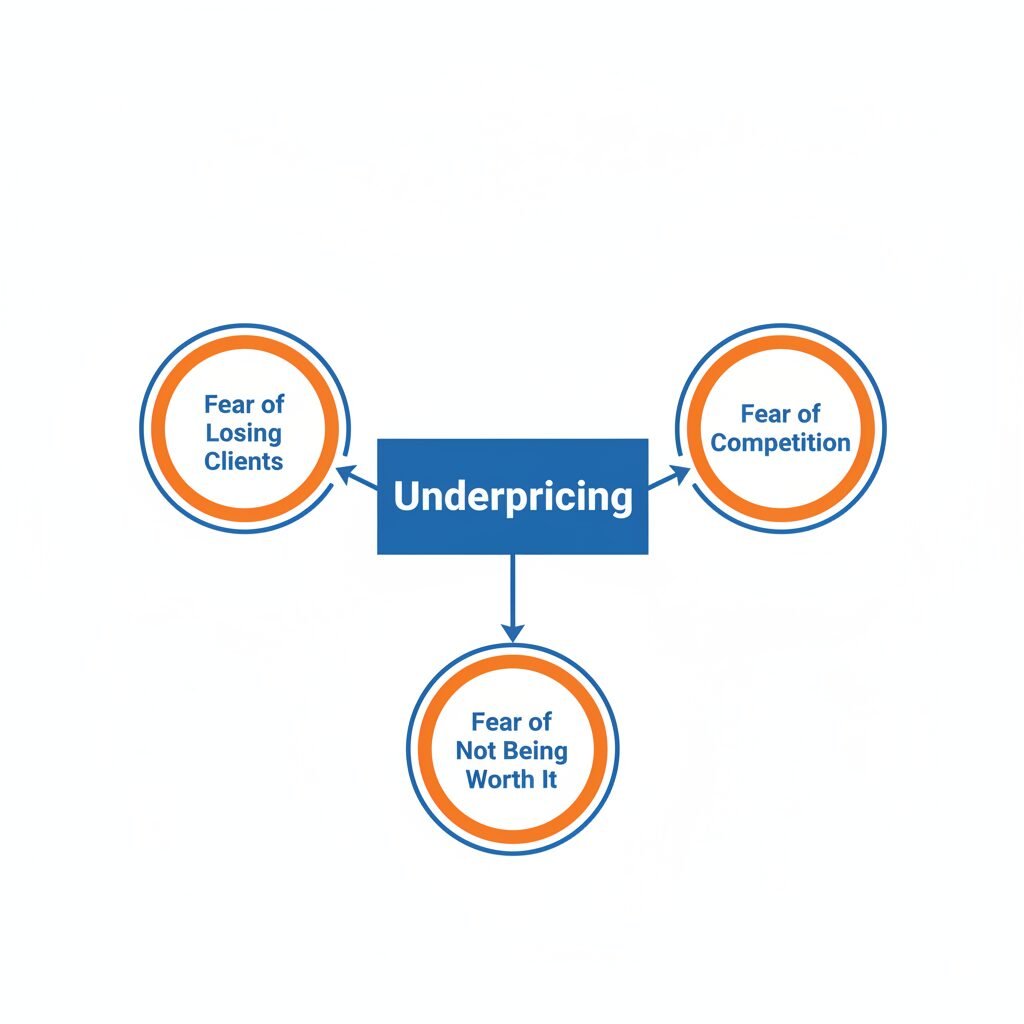

A clear pattern emerges from these conversations. The owners who struggle most with pricing aren’t struggling because they don’t know the tactics. They struggle because of three deeply ingrained fears that override everything they know about business.

Here’s what underpricing actually costs. A $750,000 revenue business that’s underpricing by just 15% is leaving $112,500 on the table every single year. That’s $9,375 per month. That’s a full-time employee you can’t afford to hire. That’s your kid’s college fund. That’s the vacation you keep postponing. And 15% underpricing is conservative. Most service businesses I talk to are 20-30% below where they should be.

This article does two things. First, it walks through a 5-minute pricing audit with five simple questions that reveal exactly whether you’re undercharging. Second, it explains the pricing psychology behind why smart business owners consistently make these pricing mistakes, so you can finally break the pattern.

This connects directly to the seven profit levers that drive every service business. Pricing (transaction size) is Lever 3, and it’s the lever most business owners are afraid to touch. Understanding why they’re afraid matters more than any pricing spreadsheet.

The 3 Fears That Keep You Undercharging

Why do smart business owners make pricing mistakes? It comes down to three fears that override logic every time.

Fear #1: Fear of Losing Clients

The biggest fear is “If I raise prices, my clients will leave.” Reality paints a different picture. Research published in the Journal of Service Research found that customer tenure significantly moderates sensitivity to price increases. Long-term customers are far less price-sensitive than business owners assume. When service businesses raise prices 10-15%, they typically lose 5-8% of clients. Do the math. You make more money with fewer clients. And the clients who leave over price? They were the price-sensitive clients who demanded the most and appreciated the least. This isn’t losing clients. It’s upgrading your client base.

Fear #2: Fear of Not Being Competitive

The worry that competitors charge less is real, but it’s the wrong frame. Competing on price is competing on the wrong thing. Clients choose service providers based on trust, expertise, results, and reliability. Price matters, but it’s rarely the deciding factor for good clients. If it is, those aren’t your ideal clients. Only 15-20% of service buyers choose primarily on price. Fighting for that 20% means losing the 80% who value what you actually deliver.

Fear #3: Fear of Not Being Worth It

Imposter syndrome hits service business owners hard. “Am I really worth that much?” Yes. You are. Your prices should reflect the value you deliver, not the time it takes. A lawyer who solves a $500,000 problem in 3 hours isn’t overcharging at $10,000. They’re solving a massive problem efficiently. Value based pricing, not time pricing. You’re not selling hours. You’re selling outcomes, solutions, and peace of mind.

The 5-Minute Pricing Audit

You don’t need a consultant to tell you if you’re underpricing. You just need to answer five honest questions. If you answer yes to three or more, you’re definitely undercharging. Even two yes answers means you’re likely leaving money on the table.

Question 1: When did you last raise prices?

If it’s been more than 18 months since you raised prices, you’re undercharging. Your costs have increased. Wages, insurance, materials, software, rent. Everything costs more than it did 18 months ago. If your prices stayed flat while your costs went up, your profit margin shrunk. Most service businesses should raise prices 3-5% annually just to keep pace with cost inflation. Five years without a price increase means you’re 20-25% below market rate.

Question 2: Are you consistently booked at capacity?

If you’re turning away work because you’re too busy, your prices are too low. Supply and demand. When demand exceeds supply, prices should rise. Service businesses should operate at 75-85% capacity. If you’re at 95-100% consistently, raise prices until demand drops to 80-85%. You need breathing room.

Question 3: Do prospects choose you based on price?

If the main reason clients choose you is because you’re cheaper than competitors, you’re undercharging and positioning yourself poorly. The most profitable service businesses compete on value, expertise, results, or specialization. Never on price.

Question 4: Are your profit margins below industry benchmarks?

According to industry benchmarking data, target net profit margins vary by sector. Service-based businesses like consulting typically achieve 20-30% margins. Skilled trades like HVAC and plumbing target 15-20%. Home services like cleaning and landscaping aim for 12-18%. If your net profit margin is consistently below these benchmarks, you’re either undercharging or operating inefficiently (or both). Below 15% means you have no cushion for slow months, unexpected expenses, or investment in growth.

Question 5: Do you feel resentful about what you charge?

If you cringe when you tell prospects your price, or feel guilty charging what you charge, you’re underpricing. Your gut knows. When you’re undercharging, you feel it. Comfortable pricing means underpricing. Slightly uncomfortable pricing means market-rate pricing. Raise prices until you feel a little nervous quoting them.

Your Score

Three or more yes answers means you’re definitely undercharging. Two yes answers means you’re probably leaving money on the table. One yes answer means there’s room for a price increase. Zero yes answers means you’re likely priced appropriately, so focus on other profit levers instead.

The 3-Step Fix for Underpricing

Step 1: Calculate Your Target Margin

Work backwards from the profit margin you need. If you want 20% net profit and your current costs are $500,000 annually, you need $625,000 in revenue. Divide that by your typical number of clients. That’s your target price per client. Compare this to what you currently charge. The gap is how much you’re underpricing. Be realistic about costs. Include everything, including your salary, benefits, vehicle, and home office.

Step 2: Implement a Tiered Increase Strategy

Don’t raise prices 30% overnight. New clients pay new rates immediately. No exceptions. Existing clients get 90 days notice of a 15% increase. Send a professional letter explaining that costs have increased and you’re adjusting pricing to maintain service quality. Don’t apologize. Most will accept it without complaint. Announce that prices will increase another 10% in 12 months.

Step 3: Change Your Positioning Before You Change Your Price

Price increases are easier when accompanied by value additions. Add a guarantee. Upgrade your service delivery. Improve your client experience. Bundle additional services. Reposition yourself with a premium pricing strategy rather than commodity pricing. Then raise prices. When you add value first, price increases feel justified rather than arbitrary.

Important Caveat

This framework assumes you’re delivering quality service that clients value. If you’re losing clients due to service issues, raising prices will accelerate the problem, not solve it. Fix delivery first. Price increases work when your value justifies the price, not as a bandage for other problems. If your client retention is below 70%, address that before touching your pricing structure. Pricing psychology matters, but it’s not a substitute for genuine value creation.

The Bottom Line

Underpricing is the silent killer of service businesses. It attracts the wrong clients, prevents you from hiring top talent, and traps you in a cycle of working harder for less money. The pricing psychology behind underpricing (fear of losing clients, fear of competition, fear of not being worth it) keeps smart business owners stuck at rates they set years ago.

The five-question audit reveals if you’re undercharging. If you answered yes to multiple questions, it’s time to act.

Don’t wait. Every month you delay a price increase is another month of leaving money on the table. Calculate your target margin this week. Announce the price increase to existing clients. Implement new rates for new clients immediately.

Remember, you’re not overcharging when you charge market rates. You’re overcharging when you deliver poor value at high prices. If you deliver excellent service, charge accordingly. Your prices should reflect the value you create, not just the hours you work.

Want to See Exactly How Much Profit You’re Missing?

I’m currently interviewing service business owners for the second edition of my book on profit strategies. During these conversations, we analyze your entire pricing structure and identify exactly how much potential profit you’re missing.

These aren’t sales calls. I walk you through the complete Pathway to Profit framework, including pricing psychology, and show you specific opportunities to increase margins without losing clients.

If you’d like to be interviewed and receive a complimentary copy of the book when published, schedule here: https://advisors.mediaacemarketing.com/contact/

There’s no cost, no pitch, just a strategic conversation about growth.

About the Author:

I’m Ryan Herrst with Media Ace Advisors. I help service business owners (annual revenue $250K-$5M, 10 or fewer employees) identify hidden profit opportunities and create clear pathways to growth. My approach focuses on systematic improvements across all seven profit levers, with special expertise in pricing optimization and the psychology that keeps business owners from charging what they’re worth.