🎧 Prefer to Listen? I turned this article into a 28-minute audio deep-dive using AI hosts who break down the Profit Vault framework. Perfect for your commute or while you’re putting out fires.

The $200,000 Question

There’s a business owner I know who turned down a $2 million offer for his company. Not because the price was too low. Because the buyer’s lawyer asked one question during the investigation that revealed the truth.

“If you got hit by a bus tomorrow, could this business operate for 90 days without you?”

The owner went silent. The lawyer waited. Finally: “Honestly? Probably not past two weeks.”

The deal died right there. Not because the numbers were bad. The company was profitable. Growing. Good clients. Solid reputation. It died because the business wasn’t a sellable asset. It was a well-paid job with the owner’s name on the building.

That question haunts every business owner who’s honest with themselves. You might never sell. You might run this business for 30 years. But that question reveals something more important than exit value. It reveals whether you own a business or whether your business owns you.

Here’s the reality most won’t say out loud. You’re working 60-70 hours per week. Revenue is up. Profit is flat, maybe even down. Your team asks you the same questions every week. You can’t take a vacation without your phone becoming your shadow. And every business guru gives you the same advice: “Document your processes!” “Create systems!” “Build SOPs!”

You nod. You know they’re right. But here’s what nobody tells you. The reason you haven’t documented anything isn’t because you don’t know how. It’s because you don’t see what it’s costing you.

This article isn’t about Standard Operating Procedures as documentation. It’s about SOPs as Profit Vaults. We’ll use the boring corporate term “SOP” for Google, but between us, we’re building profit protection systems that guard your freedom AND your bank account.

By the time you finish reading, you’ll know exactly what your missing systems are costing you, which processes to document first, and how to build your Profit Vault without spending 100 hours writing manuals nobody reads.

The System-Profit Connection Nobody Talks About

You probably found this article searching for “how to create standard operating procedures” or “SOP template for small business.” Perfect. We’ll answer that. But first, let’s talk about why those search results are all wrong.

Every article about SOPs talks about “consistency,” “quality control,” and “training efficiency.” Corporate buzzwords that make your eyes glaze over. They’re not wrong, but they’re missing the point.

Here’s the truth nobody explains. Standard Operating Procedures (your Profit Vault) aren’t documentation tools. They’re profit protection systems. Every time you answer the same question twice, you’re actively choosing to let profit leak out of your business. Not metaphorically. Literally.

Let me show you the math that changes everything.

$$Hidden\ Profit\ Leak = (Weekly\ Hours – 40) \times (CEO\ Hourly\ Rate) – (System\ Cost)$$

Let’s make this concrete. If you’re working 70 hours per week to earn $150,000 annually, here’s what’s really happening. Your CEO hourly rate is $150,000 divided by 2,080 hours, which equals $72 per hour. You’re working 30 extra hours every week. That’s 30 hours times $72, which equals $2,160 per week. Multiply that by 52 weeks and you get $112,320 annually.

You’re not a high-earning business owner. You’re two $40-per-hour employees disguised as a CEO, working for half-price, with no vacation days and no sick leave.

Over the past 18 months, I’ve walked dozens of service business owners through this calculation in my Pathway to Profit assessments. The pattern is consistent. When we calculate what their missing Profit Vaults (systems) are costing them, the number lands between $50,000 and $150,000 annually.

Not “potential revenue if we got better at marketing.” Actual profit currently hemorrhaging because the owner is trapped being the bottleneck instead of being the CEO.

The business owners who fix this don’t suddenly get more leads. They don’t launch new products. They don’t hire expensive consultants. They systematically identify their 12-15 most expensive bottlenecks, document the solutions once, and immediately reclaim 10-20 hours per week.

Those hours either convert to revenue-generating capacity (10 hours times $72 per hour times 4 weeks equals $2,880 monthly) or to actual time off, which is why you started a business in the first place.

Here’s the identity shift that matters. This is the difference between being a “skilled technician who owns a business” and being a “CEO who owns a profit-generating asset.” Same business. Different identity. Completely different bank account and completely different life.

And here’s the contrarian truth most people miss. Most people think SOPs are for the employees. They aren’t. They’re for the owner. Employees get clarity, sure. But the owner gets their life back.

The Owner Bottleneck Audit: Your Starting Point

Before you document anything, you need to diagnose where you’re hemorrhaging profit. Most business owners skip this step and start documenting random processes. That’s why 80% of SOPs sit unused in Google Drive collecting digital dust.

Start with these diagnostic questions.

What questions do your employees ask you repeatedly? If you’re answering the same question monthly, that’s a system gap. Each repeat costs you CEO time that should be spent on strategy, not being a human instruction manual.

What tasks personally require your involvement? List everything you did yesterday that someone else could do with proper instructions. These are your capacity constraints. These are what’s keeping you trapped.

What breaks when you’re unavailable? Take a day off mentally. Don’t check email, don’t answer calls. What fires erupt? Those are your critical system gaps. Those are the things holding your business hostage.

Which customer interactions demand your personal touch? Not because customers prefer you, but because nobody else knows how to handle them. This is your revenue ceiling. You can’t serve more clients than you personally have time for.

What decisions are you making that shouldn’t require CEO-level judgment? Refund approvals? Scheduling? Vendor selection for supplies under $500? These are profit leaks disguised as “staying involved.”

Now let’s calculate what these bottlenecks actually cost you.

For each bottleneck above, figure out the time per occurrence in minutes, how many times per week it happens, and your CEO hourly rate. Then use this formula: take the minutes and divide by 60, multiply by frequency, multiply by your rate, then multiply by 4 weeks.

Here’s a real example. Your employee asks “How do we handle late-paying clients?” It takes 20 minutes to explain your collections process. This happens 4 times per month. Your CEO rate is $100 per hour. The monthly cost is 20 divided by 60, times 4, times $100, which equals $133. The annual cost is $133 times 12, which is $1,596.

Now multiply that across 15-20 recurring bottlenecks. You’re looking at $30,000 to $80,000 annually in CEO time spent being a human instruction manual instead of building the business.

Want to see your exact number? I built a Profit Simulator that calculates what your missing systems are costing you. Plug in your weekly hours and annual revenue, and it shows you the hidden profit leak in real-time. It takes 2 minutes and might make you sick to your stomach. That’s how you know it’s accurate.

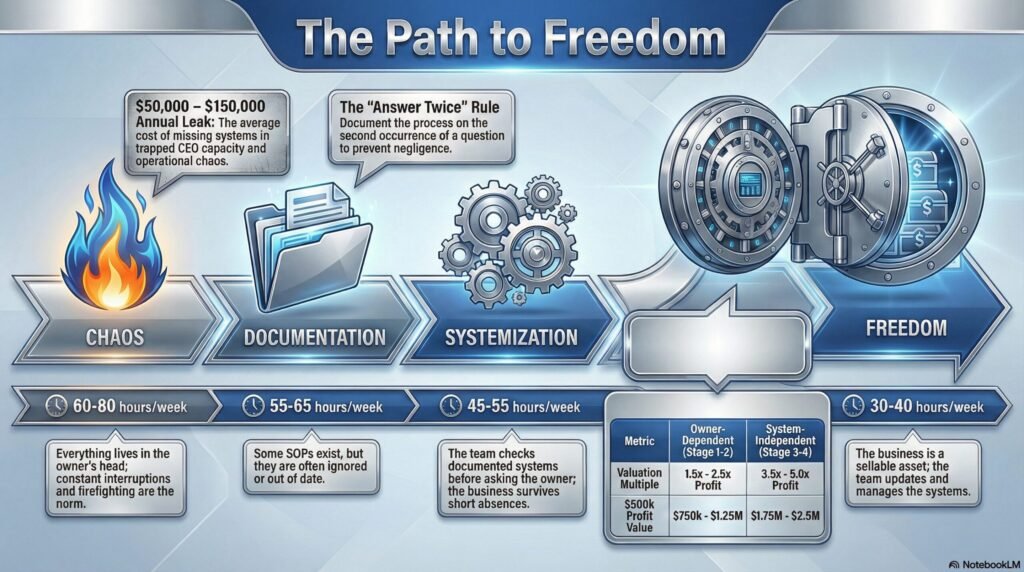

🎯 CEO Quick-Tip: The “Answer Twice Rule”

The first time you answer a question, it’s training. The second time you answer the SAME question, it’s a profit leak. The third time? That’s negligence. Document on the second occurrence.

The SOP Maturity Model: Where Are You?

Most business owners think they’re either “I have no systems” or “I have complete systems.” Reality is more nuanced. You’re somewhere on this maturity curve, and knowing where you are determines what to do next.

According to the U.S. Small Business Administration, businesses with documented standard operating procedures report 25-40% higher operational efficiency and significantly lower employee turnover rates.

Stage 1: CHAOS (The Firefighting Phase)

Everything lives in your head. Employees interrupt you constantly with questions. Customer experience varies wildly depending on who helped them. You can’t take a day off without everything falling apart. You’re working 60-80 hours per week just to maintain current revenue.

If this is you, you’re losing $80,000 to $150,000 annually in trapped CEO capacity.

What to do: Document your Top 5 Most-Asked Questions as one-page answer sheets. That’s it. Don’t try to document everything. Just those five questions. You’ll see an immediate 20% reduction in interruptions.

Stage 2: DOCUMENTATION (The “I’m Trying” Phase)

You’ve created some SOPs, probably 10-20 documents. Nobody uses them consistently. Employees still ask you questions instead of checking the manual. Your SOPs are out of date because nobody maintains them. You’re working 55-65 hours per week.

If this is you, you’re losing $50,000 to $100,000 annually. Better than Chaos, but still bleeding.

What to do: Focus on making existing docs accessible and usable, not creating more. If SOPs exist but aren’t used, that’s a people problem, not a documentation problem. Maybe they’re too long. Maybe they’re too hard to find. Maybe they’re written in corporate language nobody understands. Fix that first.

Stage 3: SYSTEMIZATION (The “It’s Actually Working” Phase)

Your team checks documented systems BEFORE asking you questions. New employees can start contributing in days instead of weeks. Customer experience is consistent regardless of who delivers. You can take 3-5 days off without major fires. You’re working 45-55 hours per week.

If this is you, you’ve reclaimed $40,000 to $80,000 in CEO capacity annually. This is where the transformation becomes real.

What to do: Expand systems to cover edge cases and complex scenarios. Focus on decision-authority frameworks. What can employees decide on their own? What needs manager approval? What requires owner input? Make those boundaries crystal clear.

Stage 4: FREEDOM (The “Business Runs Without Me” Phase)

Systems documentation is living and gets updated by the team, not just by you. Your team solves 90% or more of problems without you. Your role is strategy, growth, and vision, not daily operations. You could take 2-4 weeks off and the business would thrive. You’re working 30-40 hours per week, or less if you choose.

If this is you, you’ve unlocked full CEO capacity. That’s $100,000 to $200,000 annually in value.

What to do: Maintain systems, measure key numbers, refine based on data. Your business is now an asset, not a job.

Notice the identity shift at each stage. Stage 1, you’re “the Answer Person” with a technician identity. Stage 2, you’re “Building Systems” in a transition identity. Stage 3, you’re “the Strategic Leader” with an emerging CEO identity. Stage 4, you truly “Own an Asset” with a full CEO identity.

📊 CEO Quick-Tip: Where Are You Today?

Estimate your current stage, then calculate this. If you moved up ONE stage, what would that be worth to you in time back plus profit protected? That’s your ROI for building systems. For most owners, moving one stage is worth $30,000 to $60,000 annually.

The 3 Standard Saboteurs (Why Some SOPs Don’t Work)

Not all system problems look the same. Here are the three types of businesses that HAVE SOPs but are still broke. If you see yourself here, don’t panic. The fix is in the next section.

Saboteur #1: The Over-Documenter

This owner has 200-plus pages of detailed SOPs. Nobody reads them because they’re too complex, too long, too corporate. The owner still answers questions constantly because the docs are unusable. They spent 6 months “getting it perfect” before implementing anything.

The real problem? Confusing thoroughness with effectiveness. A 2-page usable doc beats a 20-page perfect doc nobody opens.

The cost: $60,000 to $100,000 annually. All that documentation effort, zero behavior change.

The fix: Burn the novel. Create scenario-based, 1-page answer sheets for your Top 15 questions. Implement immediately. Done is better than perfect.

Saboteur #2: The Wild West Operator

This owner says “We don’t need SOPs, we hire smart people and let them figure it out.” Every employee does things differently. Customer experience is wildly inconsistent. High employee turnover because nobody knows if they’re doing it “right.”

The real problem? Confusing autonomy with chaos. Smart people WANT guidance on company standards so they can excel within that framework. They’re not asking you to micromanage. They’re asking you to set the guardrails so they can run.

The cost: $80,000 to $150,000 annually from customer churn plus employee training inefficiency plus owner intervention on everything.

The fix: Document non-negotiables only. What MUST be consistent? Start there. Let employees innovate within guardrails. Your job isn’t to script every word. Your job is to say “Here’s what excellent looks like, now go make it happen.”

Saboteur #3: The Secret Keeper

This owner has systems documented but doesn’t share them widely. “My team isn’t ready for that responsibility.” They hoard knowledge as job security. They delegate tasks but not authority.

The real problem? Trust issues masquerading as “quality control.” If you can’t trust your team with systems, you hired wrong people. Either fix the people or fix the trust. But you can’t scale a business built on secrets.

The cost: $50,000 to $120,000 annually. The owner still does everything. Systems exist but provide zero leverage.

The fix: Document decision thresholds. Under $100, employee decides. $500, manager approves. $2,000-plus, owner approval. Share systems and empower people to use them. If they screw up, that’s data. Improve the system or improve the person.

🔍 CEO Quick-Tip: Which Saboteur Are You?

Most owners are a blend of all three. Identify your primary saboteur pattern, then jump to the fix. You’ll reclaim 5-10 hours within 30 days just by stopping the sabotage.

The 5 Non-Negotiable Profit Guards

These are the five highest-ROI systems for service businesses earning $250,000 to $5 million. Document these first. Everything else can wait.

Profit Guard #1: The Refund and Discount Authority Protocol

Every time an employee says “Let me check with my boss” on a refund, you lose time AND customer goodwill. Plus you become the “bad cop” who has to say no. Nobody wins.

Here’s the system. Under $100, employee can approve immediately, no questions asked. Between $100 and $500, manager approval required with same-day response. Between $500 and $2,000, owner approval with 24-hour response window. Over $2,000, owner approval plus documented explanation of what happened and why.

Time saved: 3-5 hours monthly handling refund requests.

Profit protected: $3,600 to $6,000 annually.

What this looks like in practice. For an HVAC company, it’s the “customer unhappy with install” protocol. For a creative agency, it’s the “client wants revision outside of scope” decision tree. For a law firm, it’s the “billing dispute resolution” framework. Same system, different language for your industry.

Profit Guard #2: The Client Onboarding Handshake

Inconsistent onboarding creates confused clients who demand your personal involvement. Consistent onboarding creates confident clients who trust your team.

Here’s the system. Day 1, send welcome email plus access credentials plus schedule first meeting. Day 3, orientation call covering what to expect, timeline, and communication preferences. Day 7, check-in asking any questions or confusion. Day 30, first milestone review.

Time saved: 5-8 hours per client because you’re not firefighting confusion.

Profit protected: $15,000 to $30,000 annually depending on your client volume.

What this looks like in practice. For an HVAC company, it’s the “new customer welcome process” for recurring maintenance. For a creative agency, it’s the “kickoff meeting structure” that sets expectations. For a law firm, it’s the “client intake and case timeline” explanation. Every industry needs this. Yours included.

Profit Guard #3: The Pricing and Proposal Decision Tree

If you’re personally involved in every proposal, you’re capping revenue at your capacity. Remove this bottleneck and you unlock growth without working more hours.

Here’s the system. Standard services under $5,000, team uses pre-approved pricing calculator. Custom projects between $5,000 and $20,000, manager scopes the work and owner approves before sending. Strategic accounts over $20,000, owner leads the proposal. Discount authority, never more than 10% without owner approval.

Time saved: 6-10 hours weekly on proposal creation.

Profit protected: $25,000 to $40,000 annually.

What this looks like in practice. For an HVAC company, it’s the “repair versus replace decision matrix” with clear pricing. For a creative agency, it’s the “package pricing structure” that eliminates custom quotes for standard services. For a law firm, it’s the “case type pricing guide” with scope boundaries. Stop custom-quoting everything. Build the calculator once.

Profit Guard #4: The Customer Complaint Resolution Playbook

Unhappy customers who reach you personally mean your team didn’t know how to handle it. Every escalation to you is a system gap costing you time and exposing business risk.

Here’s the system. Acknowledge the complaint within 2 hours even if the solution takes longer. Categorize it as service issue, billing issue, communication issue, or expectation mismatch. Then handle based on category. Service issues, fix immediately and report to manager. Billing issues, manager handles. Communication issues, employee resolves and documents what happened. Expectation mismatch, manager tries to resolve but escalates to owner if they can’t.

Time saved: 4-6 hours monthly handling escalations.

Profit protected: $5,000 to $9,000 annually.

What this looks like in practice. For an HVAC company, it’s the “service call complaint protocol” with specific fix options. For a creative agency, it’s the “revision request framework” that separates scope from satisfaction. For a law firm, it’s the “client concern escalation path” with clear decision points. Complaints will happen. The question is whether they all land on your desk or get handled at the right level.

Profit Guard #5: The Weekly Metrics Dashboard (The “CEO Cockpit”)

You can’t manage what you don’t measure. If you’re making decisions based on gut feel instead of data, you’re flying blind and hoping for the best.

Here’s the system. Track these numbers weekly: new leads, conversion rate, average project value, client retention, and profit margin. Use a 1-page dashboard format updated every Monday morning. Hold a 15-minute Monday meeting asking what’s working and what’s not. Set a decision trigger: if any number drops 15% from your baseline, investigate immediately.

Time saved: 3-4 hours weekly gathering scattered data from different places.

Profit protected: $15,000 to $20,000 annually from better decisions and fewer expensive mistakes.

This one looks the same across all industries. The specific numbers you track might vary slightly, but every business needs to know these five metrics weekly. Not monthly. Not quarterly. Weekly. That’s how you catch problems before they become disasters.

Total Impact of These 5 Profit Guards:

Time Saved: 21-33 hours monthly

Profit Protected: $63,600 to $105,000 annually

Implementation Time: 2-4 hours per system, so 8-20 hours total

⚡ CEO Quick-Tip: The 80/20 Implementation Plan

Document Profit Guard #3 (Pricing) first if you’re revenue-constrained and need to unlock capacity. Document Profit Guard #2 (Onboarding) first if you’re capacity-constrained and drowning in customer confusion. Pick one. Implement this week. See results within 30 days. Then do the next one.

💸 The Hidden Costs of No Systems

Beyond your trapped CEO time, missing Profit Vaults cost you in ways most owners never calculate.

Customer churn. Inconsistent service drives away 15-30% more customers than you realize.

Employee turnover. When your team doesn’t know how to succeed, you get 20-40% annual turnover and constant training costs.

Repeat mistakes. The same errors keep happening because nobody documented what went wrong last time. This costs 5-10% of revenue annually in rework and refunds.

Lost opportunities. You can’t take on new clients when you’re already maxed out. Every “no” to a qualified lead is revenue you’ll never see.

Total additional cost beyond trapped time: Another $30,000 to $80,000 annually that just disappears into operational chaos.

What Are the 5 Components of a Profitable SOP?

Most SOP guides tell you to include: Title, Purpose, Scope, Procedures, Revision Date. That’s fine if you’re a Fortune 500 company trying to pass an audit. It’s useless for a service business trying to reclaim your life.

For a profit-focused service business, your Profit Vault documents need these five components instead.

Component #1: The Scenario Trigger. Start with “When THIS happens…” not “Step 1, Step 2…” People don’t think in steps. They think in situations. Example: “When a client asks for a refund on a project under $500…”

Component #2: The Decision Authority. Who can decide what? Be crystal clear and specific. Example: “Employee can approve immediately. No manager approval needed.” Don’t make people guess. Tell them.

Component #3: The Action Steps (Keep It Short). What specifically to do. 3-7 steps maximum. Use bullets, not paragraphs. If it’s longer than that, break it into two separate SOPs or make a video instead.

Component #4: The Quality Check. How do you know it was done right? Example: “Client should receive confirmation email within 2 hours.” This is how you maintain standards without micromanaging.

Component #5: The Exception Protocol. What happens if this doesn’t cover the situation? Example: “If refund is over $500, escalate to manager immediately. If manager isn’t available within 4 hours, escalate to owner.” Always have an escape hatch for edge cases.

Format recommendation: One page. Scenario at top. Steps in middle. Exception protocol at bottom. If it’s longer than one page, it’s too complex. Break it into multiple SOPs.

📄 CEO Quick-Tip: The One-Page Rule

If your SOP is 3-plus pages, nobody will use it. Aim for 1 page per scenario. If you need more detail, link to a video walkthrough using Loom instead of writing a novel. A 5-minute video beats a 10-page document every single time.

What’s the Difference Between a Workflow and an SOP?

People use these terms like they mean the same thing. They don’t. Here’s the distinction that actually matters.

A workflow shows the sequence of WHO does WHAT. The focus is on handoffs between people or departments. The format is usually a flowchart or diagram. Example: “Lead comes in, Sales qualifies, Sales Manager approves, Onboarding Specialist starts, Delivery Team executes, Account Manager maintains.”

An SOP (your Profit Vault) shows HOW one person does their specific part. The focus is detailed instructions for ONE role’s responsibility. The format is written steps or video walkthrough. Example: “How the Sales team qualifies a lead” as a separate document from what happens after they qualify it.

Why this matters: You need BOTH. Workflow shows the big picture and prevents things from falling through cracks. SOPs show the details and prevent quality inconsistency.

The implementation order matters too. Map workflows first because this shows where handoffs break. Create SOPs second to document how each person completes their part. Update workflows third as SOPs reveal broken handoffs you didn’t see before.

Don’t build SOPs without workflows. You’ll document how people currently operate, which might be inefficient or broken. Map the ideal workflow first, THEN document how to execute each step.

The Tech Stack of the Systemized CEO

You don’t need expensive software to build effective Profit Vaults. Here’s the minimal tech stack for a service business under $5 million.

Layer 1: Where SOPs Live (Documentation)

Option A is Google Drive, which is free. Create one folder called “Profit Vault – Team Systems.” Make sub-folders by department: Sales, Operations, Customer Service, Admin. Each SOP is a Google Doc. The upside is it’s free, everyone has access, and it’s searchable. The downside is no version control and it can get messy fast.

Option B is Notion, Confluence, or ClickUp at $0 to $20 per month. These give you more structure than Google Drive and work better for growing teams with 10-plus employees. They have built-in templates and organization. The upside is clean interface, version history, and interconnected documents. The downside is learning curve and monthly cost.

Pick whichever one your team will actually use. The best system is the one that gets used, not the fanciest one.

Layer 2: How to Create SOPs Fast (Process Capture)

Loom is free for up to 25 videos. Record your screen while you do a task. Narrate what you’re doing as you do it. Share the link with your team. A 5-minute video beats a 5-page document every single time. Employees can rewatch without asking you.

Tango is also free. It automatically captures screenshots as you complete a task. It generates a step-by-step guide with images. Perfect for software-based processes. Zero editing required. Just do the task once and Tango documents it for you.

Layer 3: Where Work Happens (Task Management)

Asana, Monday, ClickUp, or Trello cost $0 to $15 per user monthly. You assign tasks based on your documented SOPs. Track what’s done, what’s in progress, and what’s stuck. This reduces “Where are we on X?” questions by 80%. Choose based on preference. They all work fine. Pick one and stick with it.

Layer 4: Where Questions Get Answered (Communication)

Slack or Microsoft Teams cost $0 to $8 per user monthly. Create channels for each Profit Vault document. When someone asks a question, answer it AND update the SOP. The searchable history means people can find answers without asking. This drastically reduces email clutter.

The AI Multiplier

Use ChatGPT, Claude, or similar tools to draft SOP outlines from your voice notes, turn messy notes into clean procedures, create scenario-based variations of your core processes, and generate training quiz questions to test understanding.

Here’s the hack. Voice-record yourself doing a task while narrating using your phone. Upload to ChatGPT or Claude. Prompt: “Turn this into a 1-page SOP with scenario trigger, action steps, and exception protocol.” Edit the output for 10 minutes. You just created a Profit Vault document in 20 minutes instead of 2 hours.

Total monthly cost: $0 to $100 depending on your team size.

Time saved: 8-12 hours monthly finding information and answering repeat questions.

ROI: If your CEO rate is $100 per hour, you break even by saving 1 hour. Everything after that is pure profit protection.

🤖 CEO Quick-Tip: The AI Documentation Hack

Voice-record yourself doing a task while narrating. Use your phone. Upload to ChatGPT or Claude. Prompt: “Turn this into a 1-page SOP with scenario trigger, action steps, and exception protocol.” Edit the output for 10 minutes. You just created a Profit Vault document in 20 minutes instead of 2 hours. This is how you document fast.

Why Business Brokers Hate You (And What It Means Even If You Never Sell)

Remember that “$200,000 question” from the beginning? “If you got hit by a bus, could this business operate for 90 days?” Let’s talk about why that question kills deals and costs you money even if you never sell.

When someone thinks about buying your business, they’re asking one question: How risky is this? The riskier it looks, the less they’ll pay. Or they won’t buy at all.

Here are the investigation questions that expose system gaps. “How do you document your customer delivery process?” Translation: Can someone other than you replicate the service? “What happens if your top employee quits tomorrow?” Translation: Is tribal knowledge documented or locked in people’s heads? “Show me your operations manual.” Translation: Can a new owner step in without you? “How long does it take to train a new team member?” Translation: Are processes documented or learned by following you around? “What percentage of customers require your personal involvement?” Translation: Are you the product, or do you have a scalable business?

Here’s the math on how this affects value. Businesses get valued as a multiple of annual profit. That multiple is determined by risk.

An owner-dependent business with no Profit Vaults gets a multiple of 1.5 to 2.5 times annual profit. So $500,000 in annual profit times 2 equals $1 million valuation.

A systemized business with complete Profit Vaults gets a multiple of 3.5 to 5 times annual profit. So $500,000 in annual profit times 4 equals $2 million valuation.

The difference is $1 million in enterprise value. Same profit. Different systems.

Here’s the side-by-side comparison of what buyers actually evaluate:

| What Buyers Evaluate | Owner-Dependent Business (Low Value) | System-Independent Business (High Value) |

| Sales Process | Owner closes every deal | Team uses documented decision trees |

| Service Delivery | Knowledge lives in people’s heads | Step-by-step Profit Vaults guide the team |

| Problem Solving | Everything escalates to owner | Exception protocols handle 90% of issues |

| Owner Vacation | Owner checks email daily | Owner is completely off-grid |

| Business Risk | Owner is single point of failure | Replicable, scalable model |

| Valuation Multiple | 1.5x-2.5x annual profit | 3.5x-5x annual profit |

| $500K Profit = | $750K-$1.25M value | $1.75M-$2.5M value |

Why this matters even if you never sell: That valuation multiple is a measure of business health, not just exit value. A 2x business means “The owner IS the business” which equals high stress and no freedom. A 4x business means “This is an asset that generates profit predictably” which equals scalable and freeable.

The path from 2x to 4x isn’t rocket science. It’s Profit Vaults. Document how you deliver value so it’s replicable by others. Document how you make decisions so they’re consistent. Document how you handle problems so they don’t require you personally. Track your key numbers so performance is measurable not mysterious.

Timeline: 6-12 months of focused system-building can double your enterprise value. Not “potential value if everything goes perfect.” Actual defendable valuation based on reduced business risk.

💰 CEO Quick-Tip: The Silent Equity Build

Every Profit Vault you create increases your business value by reducing key-person dependency risk. Even if you work this business for 20 more years, you’re building an asset that could provide liquidity for retirement, family wealth transfer, or management buyout. You’re not just reclaiming time. You’re building sellable equity.

When NOT to Build a Profit Vault

Honesty time. Not every process should be documented. Building Profit Vaults (SOPs) for the wrong things wastes time and creates unusable systems. Here’s when to SKIP documentation.

Skip broken processes. Don’t document a process that doesn’t work. Fix it first, THEN document the improved version. Bad approach: “Here’s our current client onboarding process” that gets 20% complaints. Good approach: “Let me fix why clients are confused, THEN I’ll document the new process.”

I tell my clients in Grand Ledge the same thing: Don’t document a mess. If your current way of doing things is slow or makes people mad, documentation just makes the mistakes happen faster. Fix the flow, then lock the vault.

Skip one-time events. If something happens once per year or is completely unique each time, documentation probably isn’t worth the effort. Example: Annual holiday party planning is too variable to systematize effectively. Just plan it fresh each year.

Skip highly creative work. Some aspects of your business SHOULD be customized and creative. Don’t over-systematize what makes you unique and valuable. Example: Brand strategy development, custom design work, bespoke consulting advice. These need your brain, not a template.

Skip rapidly changing processes. If a process changes weekly because you’re still figuring it out, wait until it stabilizes before documenting. Otherwise you’re constantly rewriting docs instead of improving the actual work.

Skip strategic decision-making. Some decisions should stay with you as the owner. Don’t create SOPs for things like long-term vision setting, major pivots or strategy shifts, or who to hire for leadership roles. These are owner decisions that shouldn’t be delegated.

The balance that works: 80% of your business CAN and SHOULD be systematized. That’s delivery, operations, customer service, and admin. The remaining 20% should stay flexible, creative, and strategic. That’s your actual CEO work.

The mistake most owners make is protecting the WRONG 20%. They keep repeatable tasks that should be systematized. Then they try to systematize creative work that should stay flexible. Get this backwards and you’ll hate your own systems.

🎯 CEO Quick-Tip: The Systemization Filter

Ask yourself: “Would I want this done EXACTLY the same way 100 times, or do I want flexibility?” If you want it done the same way every time, build a Profit Vault. If you want flexibility and judgment, leave it to the person’s brain. Most owners overestimate how much needs flexibility. The answer is usually “systematize it.”

Your 30-Day Implementation Roadmap

Most owners read this article and think “That’s a lot. Where do I actually start?” Here’s your roadmap to go from chaos to systems in 30 days without overwhelming yourself or your team.

Week 1: The Audit

Do the Owner Bottleneck Audit from earlier in this article. Identify your Top 5 most-asked questions. Calculate what they’re costing you using the formula we covered. Write down the actual dollar amount. That number is your motivation.

Week 2: Document One Thing

Pick your highest-cost bottleneck from Week 1. The one that costs you the most time or money. Document the answer as either a 1-page document or a 5-minute Loom video. Put it somewhere your team can find it easily. Share it with the team and tell them “Next time this comes up, check here first.”

Week 3: Test and Refine

Watch whether your team actually uses what you documented. If they still ask you the question, the doc isn’t clear enough. Improve it. Make it simpler. Make it more specific. Add examples. If they DO use it and stop asking you, celebrate the time you just saved.

Week 4: Repeat

Document your second-highest bottleneck using the same process from Week 2. By the end of this month, you’ll have 2-3 Profit Vaults built. You should see 3-5 hours reclaimed weekly. That’s 12-20 hours monthly. At a $100 per hour CEO rate, you just protected $1,200 to $2,000 in monthly profit.

This roadmap shows you that progress is possible in 30 days, not “someday when I have time.” You’ll never have time. You have to MAKE time by doing this work now.

A Real Business Example

Here’s what this looked like for one contractor I worked with recently. His name and details don’t matter. What matters is the pattern because it’s the same pattern I see everywhere.

His team asked him the same five questions every single week. “Can we give this customer a discount?” “How should we handle this installation issue?” “Should we schedule the followup now or later?” “What do we do if the customer isn’t home?” “How much should we charge for this add-on work?”

Each answer took 10-15 minutes because he had to explain context and reasoning, not just give a yes or no. He was spending 6-8 hours every week answering these same five questions for different customers or different employees.

We documented those five answers in a shared Google Doc with scenario-based responses. Not complicated. Just “When this happens, do this. When that happens, do that.” With clear decision thresholds like “Discounts up to 10% for repeat customers, you can approve. More than that, check with me.”

Week 1 after implementing: His interruptions dropped by 60%. He got maybe 2-3 questions instead of 10-12.

Week 4: He reclaimed 8 hours per week. Eight hours he could spend on strategy, sales, or just not working.

Month 3: He took his first full weekend off in two years without a single panicked phone call from his team.

That’s the transformation. Not theoretical. Not someday. Real, measurable, life-changing results from documenting five simple answers.

The Pathway to Profit Assessment

You now know what most business owners never figure out. The reason you’re working 60-70 hours for flat profit isn’t a marketing problem or a sales problem or a people problem. It’s a systems problem disguised as a profit problem.

Your missing Profit Vaults are costing you somewhere between $50,000 and $150,000 annually in trapped CEO capacity. That number isn’t theoretical or exaggerated. It’s actual profit leaking out because you’re the bottleneck.

The business owners who fix this don’t suddenly find 20 extra hours per week lying around. They don’t hire expensive consultants to do it for them. They systematically identify their highest-cost bottlenecks, document solutions once (often in under 20 minutes using tools like Loom), and immediately reclaim CEO time that either generates revenue or restores their life. Usually both.

The transformation isn’t “I documented some processes.” The transformation is “I’m no longer the business. I’m the CEO who owns an asset that generates profit predictably.” That’s the identity shift that changes everything.

Here’s your challenge: You can’t fix what you can’t measure. You need to know EXACTLY where your profit is leaking and which Profit Vaults to build first for maximum impact.

That’s what my Pathway to Profit diagnostic reveals. It’s a 90-minute deep-dive where we identify your specific owner bottlenecks (not generic advice, your actual constraints), quantify what each bottleneck costs in time and profit (the real numbers based on your business), prioritize which Profit Vaults to build first for maximum ROI, and calculate your profit opportunity over the next 12 months.

What makes this different: This isn’t a sales pitch disguised as a consultation. It’s industry research for my book’s second edition where I interview business owners about their profit challenges and system gaps. You get a detailed assessment of where your $50,000 to $150,000 profit opportunity is hiding. I get insights into what’s working and what’s broken in your industry. If it makes sense to work together after that conversation, great. If not, you walk away knowing exactly what to fix and in what order.

The process works like this. First, book a 45-minute book interview, which is completely free industry research. Second, if you qualify and want to go deeper, we schedule the 90-minute Pathway to Profit diagnostic. Third, you get a clear roadmap showing your specific profit leaks and Profit Vault priorities.

The investment: The book interview is free because I’m gathering research. The Pathway to Profit diagnostic is complimentary for qualified business owners ($250,000 to $5 million revenue, service-based, owner-still-involved-daily). I work with service businesses across Michigan and nationally, from my office in Grand Ledge.

The commitment from you: Show up prepared to discuss your numbers honestly. That’s it. No pressure. No hard sell. Just honest assessment of where your business stands and where the opportunities are.

Book Your Free Book Interview →

The reality you’re facing: You’re either going to spend the next 12 months working 70-hour weeks for the same profit, or you’re going to build the Profit Vaults that set you free. The bus question will get answered either way. Better to answer it on your terms while you’re still in control.

Frequently Asked Questions

Q: What is a good SOP format for a service business?

For service businesses, skip the corporate format entirely. Use this 1-page structure: (1) Scenario Trigger (“When X happens…”), (2) Decision Authority (“Who can decide what”), (3) Action Steps (3-7 bullets max), (4) Quality Check (“How you know it’s done right”), (5) Exception Protocol (“What to do if this doesn’t cover it”). If your SOP is longer than one page, break it into multiple SOPs or use a video walkthrough instead. Remember, done and usable beats perfect and ignored.

Q: What are standard operating procedures examples for small business?

The five highest-ROI SOPs for service businesses are: (1) Refund and Discount Authority Protocol so employees can make decisions without you, (2) Client Onboarding Process so every customer has a consistent experience, (3) Pricing and Proposal Decision Tree so you’re not involved in every quote, (4) Customer Complaint Resolution Playbook so problems get handled at the right level, (5) Weekly Metrics Dashboard so you make data-driven decisions instead of guessing. These five systems alone typically recover $60,000 to $100,000 annually in trapped CEO capacity.

Q: How many SOPs should a small business have?

Quality over quantity always. Most service businesses need 15-25 core SOPs covering customer-facing processes (onboarding, service delivery, problem resolution), internal operations (decision authorities, approval thresholds, communication protocols), and administrative workflows (invoicing, scheduling, reporting). Start with your Top 5 most-asked questions. That alone solves 80% of your interruptions. Then add more as you identify additional bottlenecks. Don’t try to document everything at once. That’s how you get overwhelmed and quit.

About the Author

Ryan Herrst is a Certified Profit Advisor and published author of “Profit Foundation” who helps service-based business owners discover hidden profit opportunities, typically six figures or more, without spending additional money on marketing. Through his proprietary Pathway to Profit assessment and systematic profit strategies, he’s helped over 100 business owners break through revenue plateaus and reclaim their time and freedom. Based in Grand Ledge, Michigan, Ryan works with service businesses nationwide earning $250,000 to $5 million annually.